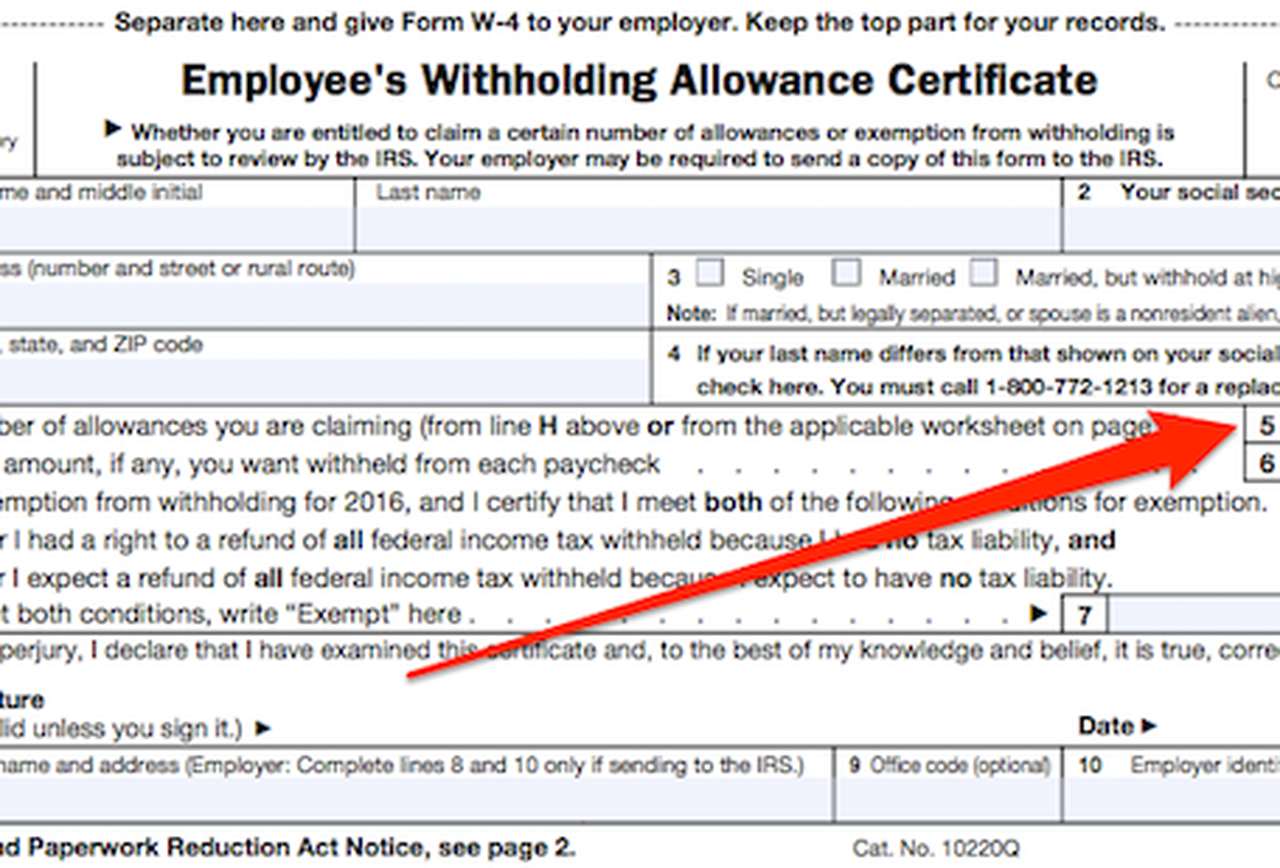

Employees also have the option to either increase or decrease the amount of their withholding. According to the IRS, it’s generally a good idea to consider increasing withholding if you have two (or more jobs) or if your spouse also works. You should also consider this step if you have self-employment income or other income where no taxes are withheld. If you are someone who likes receiving a bigger tax refund with your annual return, changing your W-4 form to get more money with your refund is easy. You can choose what additional amount, if any, you want withheld from each paycheck on line 4(c) of the W-4 form. It’s always a good idea to review and adjust your W-4 withholding after major life events that may impact your tax liability such as getting married, having a child, or receiving a big raise.

Tax Compliance

The withholding amount generally depends on a taxpayer’s filing status, number of jobs, other income, and whether they have dependents. A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee’s paycheck and transmits to the IRS on their behalf. To change their tax withholding, employees can use the results from the Tax Withholding Estimator to determine if they should complete a new Form W-4 and submit to their employer. And if the number of withholding allowances you can claim actually goes down, you have to resubmit a new W-4 with the lower withholding allowances within 10 days of the change. If your situation changes, you can update your W-4 and submit it to your employer.

Updating Your W-4 Form

If you are married and have two kids, you can claim three or more allowances. Whether you’re looking ahead to the upcoming tax season or filing back tax returns online, it’s important to choose wisely. The details to your specific situation (such as your filing status, what does zero allowances mean number of children, etc.) will determine how you complete your W-4. Whether you want more money in your refund or more money in your paychecks, you can use the TaxAct withholding calculator to see how changes to your W-4 form will impact your take-home pay.

Head of Household, 1 Child

Doing so will ensure that you don’t get hit with a nasty tax bill out of the blue or essentially give the IRS an interest-free loan. Be sure to file a new Form W-4 if your personal or financial situation changes. If you don’t, you could end up having too little money withheld throughout the year, which would affect what you must pay come tax time. But the IRS revamped and simplified the W-4 form and how taxpayers should determine their withholding. Now, withholding amounts relate to whether an individual has multiple jobs or a spouse who works, what credits they can claim, and other adjustments. In order to decide how many allowances you can claim, you need to consider your situation.

What is the best tax withholding for a single person?

You’ll find the Personal Allowances Worksheet on the third page of Form W-4. This form can guide you through a basic rundown of how many allowances you’re eligible to claim, and whether you’ll need to fill out the more-complicated worksheets that follow. Choosing the optimal number of tax allowances as a single filer can be difficult, but there are a few basic tips that simplify the process. The important thing is understanding how many allowances you can legally claim and how those claims will affect withholding. For two earners and multiple jobs, you will want to make sure that you are calculating the total number of allowances you are entitled to correctly. If you are filling out more than one W-4 form, then you will not want to claim the maximum number of allowances you are entitled to on each form.

Allowances With Multiple Jobs

- Whatever your accounting needs and circumstances, our experts can assist you in making informed decisions and planning effectively so you won’t miss out on significant tax planning opportunities.

- The amount that is withheld from each of your paychecks is determined by your total earnings annually and your filing status.

- If you have a big tax bill after filing, you’ll want to lower the amount of allowances on your W-4 for next year.

People who do contract work or are independent business owners don’t get a portion of their paychecks withheld for them. You should always keep track of how much income tax you owe so you can add allowances and withholding tax accordingly. This way, you can strike a balance, avoid overpaying and underpaying and avoid any kind of penalties placed by the IRS. This occurs when you set your relationship status as “married,” giving the impression that you are the only one who works. Combined, the income surpasses the tax bracket, resulting in a higher tax.

However, with time, they have fared well with just a little help. Instead of giving your money to the federal government, it is better to keep it and spend it on more important things. By owing taxes rather than getting a refund, you have more control over your money. You should not claim too many allowances, or you might end up having to pay the IRS. Claiming 0 allowances means that too much money will be withheld by the IRS.

Typically, the more allowances you claim, the less amount of taxes will be withheld from your paycheck. The fewer allowances you claim, the greater the amount of a refund you might be eligible for. Depending on your circumstance, you might have under-withheld and owed money, or received a larger refund than usual when you filed your taxes. Ideally, Form W-4 should make it so you neither owe taxes nor get a refund when you file your tax return — which is what led to it being reworked.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they’re not past the age of 19. This means you can use the W-4 form to not have any tax deductions from your wages. You may be able to claim exemption from withholding if you had the right to a refund of all your income tax due to no tax liability the previous year.

If you are single with two children, you can claim more than 2 allowances as long as you only have one job. You will be able to request an allowance for each child that you have. If you are in any doubt, you will want to consult with a tax professional. Even though he was married and had two kids but still claimed zero.